When you establish a realistic budget, you increase your control over your finances and your ability to reach any financial objective. Whether it be to reach financial independence like us, get rid of debt or to save for a specific expense like a trip, down payment or other, your budget will help you determine how fast you can reach this goal.

Learning to track spending accurately

When I was still working on paying off my $20,000 consumer debt, I often prepared unrealistic budgets since I was not efficient at planning my expenses. As a result I would end up missing my objectives of paying down my debt or worse, would need to borrow more money on my credit margin in order to pay a bill.

Eventually I understood that to plan a realistic budget, I would need to track my expenses rigorously and over a long period of time, since some expenses only occur once or twice a year.

Furthermore, this technique allowed me to be aware that there are periods of time when it is essential for me to have more cash on hand for occasional expenses such as when it is time to pay for our municipal taxes.

The exercise of tracking our expenses is also highly beneficial in identifying problem areas where there is spending that don’t align with your values and your objectives. It greatly helped me learn how to build and maintain a good emergency fund that would account for my cash-flow needs.

Here are the steps I take to plan a realistic budget:

1. Track our expenses:

There are many ways to track your expenses, it could be done the old fashion way by keeping all your receipts and adding them up by category at the end of the month or it could be done with one of the many software and website at your disposition, which allow most of this task to be automated.

Since I am always looking to simplify things and free my time, I opted for the second option by using Mint to track all of our expenses. It is a fantastic website that is simple to use.

The site compiles all transactions we have done on our credit and debit cards, and I can select in which category the expense should be added. I can even add transactions manually, such as when I would purchase something with cash, and am also able to add expense categories.

I visit Mint at least once per week to make sure that all our recent transactions have been classified in the correct categories. This is a task which takes me a few minutes and is easy to do if done regularly since the expense is fresh in my mind. It’s much easier than, for example, having to try to remember what we bought at Walmart a month ago for say $13.97.

This site offers a ton of other functions and I probably only use a few of the features since, as you will see below, I prefer to record the totals in an Excel sheet at the end of the month in order to track my expenses on the long term.

The reason why I complicate my life a bit by doing that is that I am more comfortable with Excel to analyze numbers on a longer term. I find that it allows me to use visual examples to better compare my expenses on a month to month or year to year basis. I also find it is easier to use the Excel sheet to track recurring expenses that only come a few times a year instead of on a monthly basis.

2. Compiling our monthly expenses on an annual basis with our budget in mind:

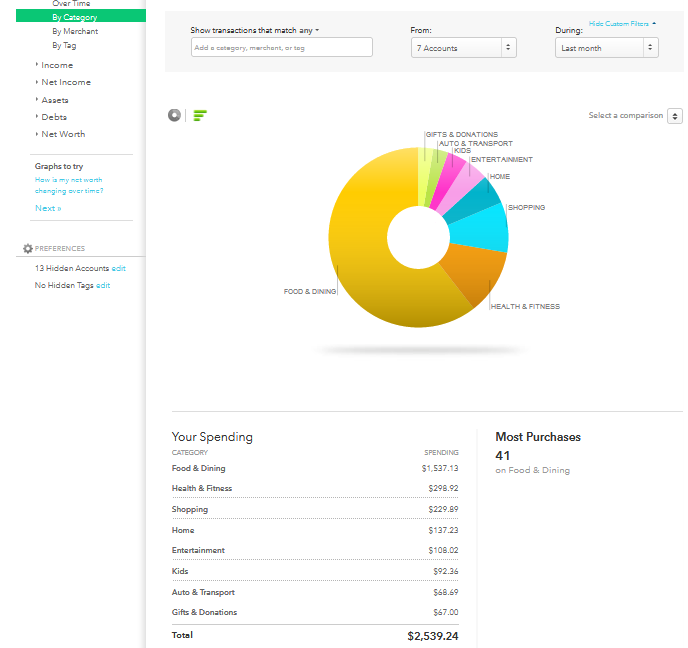

The first week of the month (more precisely around the 5th day in order to make sure that all the expenses of the previous month have been correctly entered), I open the ‘’Trends’’ page in mint and I choose to classify my spending by category for the last month.

Example from the Trends page on Mint

The total expenses are sorted by category. I make sure I did not forget any expense and then I manually enter all my numbers per category in my Excel sheet, making sure every category in my Excel sheet is covered.

Once those steps are completed, I verify what my new monthly average of spending is per category.

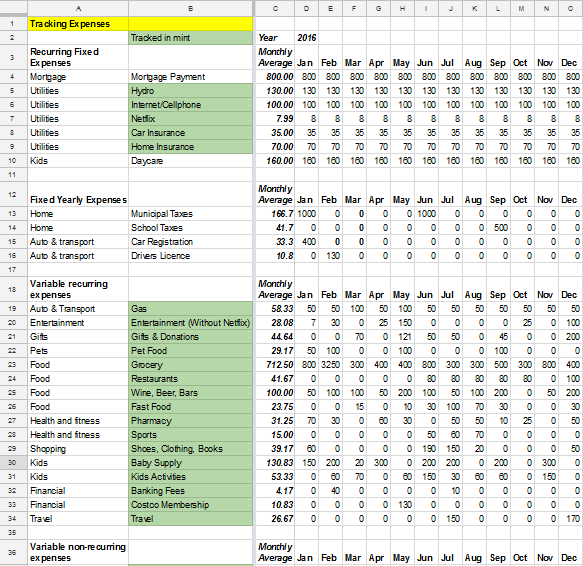

Here is an example of a section of my Excel sheet with fictitious numbers:

My sheet contains some customization like subcategories from my totals in Mint. It all depends on what I consider is important to track separately. It’s up to you to choose which category you feel might need a bit of extra tracking.

By having a full year of expenses with each month side by side, it is often quite obvious when there is excess spending in one category, for example I am always surprised by how my ‘’gift’’ category goes up in December no matter how much I try not to go crazy with gifts.

3. Create our budget based on the monthly average from my tracking sheet and on our spending objectives.

The monthly average of our spending is then a very useful tool to prepare a budget. By analyzing the numbers in each category, I can identify realistic limits to our expenses based on what we actually spent in the past year or months per category.

These limits can then guide me when I track our new transactions in Mint. You even have the option to set limits directly in Mint which can then send you notifications when you are heading over that limit for the current month.

When preparing a budget, it is important to keep in mind any financial objective you have or any potential event that could require large sums of money. You can then review your category limits accordingly in order to reach your objectives.

In our case, when we bought our 1960’s home, we knew there would be some large renovations to be done and decided to space these out by projects, over the first several years of owning it. We therefore plan ahead to increase our savings for our planned renovations before they occur.

One important tip to account for potential unplanned expenses : you can add a miscellaneous category in your budget based on past surprises. You might even want to add in a 10% buffer for this category; that is taking your average past historical unplanned expense amount and multiply it by 1.10.

This can help you avoid getting into a situation where you don’t have cash available for a bad surprise and might help you plan your savings accordingly to your cash-flow need. I found this strategy quite helpful when we did not have extended periods of having tracked our spending.

4. Continue tracking our expenses and adapting our budget

Our budget is always a work in progress since our needs change through time. Sometimes we have unplanned expenses. For example our car might have a sudden mechanical problem, therefore our budget needs to be adapted in order to face these circumstances.

At other times, we find new ways to spend less in a specific category and choose to adjust our spending limit in that category to a lower amount. The important thing is to remain constant in the tracking of our spending in order to reach our objectives.

The longer you track your expenses, the better you will get at planning them and get control of them. By regularly seeing in which categories you tend to spend more, you’ll be able to identify areas where you might need to put in a bit more effort in order to spend according to your values or objectives.