In the uncertainty of the current times, I’ve been so grateful that we have been tracking our expenses so diligently since at least 2014. Thanks to this habit, we have a pretty good idea of a simple bare-bones budget that we could implement by reducing certain expenses that we consider as discretionary expenses should we need or want to.

Having a simple bare-bone budget drafted out, even if you have no plans of currently implementing it, is such a powerful tool. It gives you the confidence that you could adapt to various circumstances. For example, if one of our income was reduced or one of us lost our job, we know that we can cut some expenses and stretch our savings out further.

See below the article for a link to sign-up and get My FREE Simple Bare-Bones Template which you can copy to fill-out with your own numbers!

The Power of Tracking your Expenses

We are extremely lucky that our income has not been at risk and that we are already quite far on our FI path. I’m very aware that not everyone is in the same situation. Some of the clients I’ve been coaching have had to deal with shifting or lower income due to the various closures and changes caused by this global pandemic.

The one thing that has repeatedly been cited as the most helpful through these times by my clients has been the fact that when working with me, they diligently track their expenses. This habit is pretty crucial to be able to set realistic expenses in your own simple bare-bones budget.

Additionally, tracking and ideally doing so closely to when you’ve incurred the expenses, is greatly helpful in allowing you to grasp a direct link between your actions and identify those that tend to cause you to spend more than you would like. Finding those links then helps you take concrete steps to modify your behavior to reduce your spending.

Furthermore, by tracking, you can find out what is a sustainable target to budget in specific categories of expenses, especially for those variable and discretionary expenses. It’s definitely a key habit to establishing a realistic budget by tracking your expenses.

Creating Your Simple Bare-Bones Budget

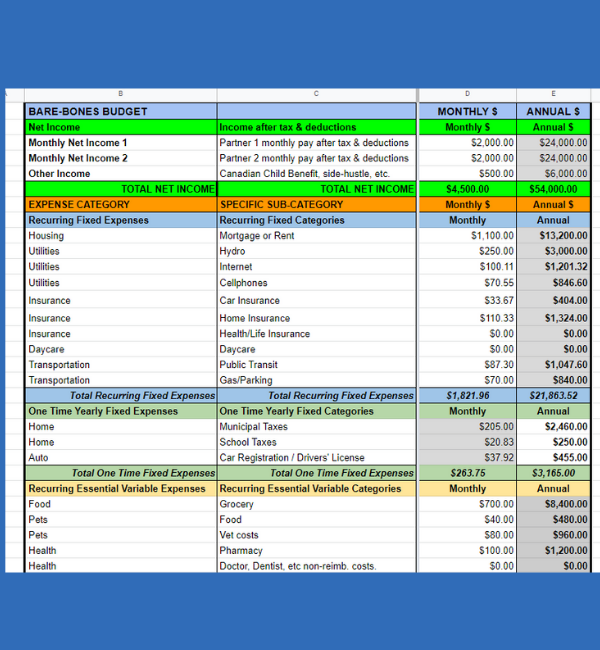

The template I created will serve to clearly show the potential gap that would exist between your income and your bare-bones expenses.

Therefore the first part of this exercise will be to input your average monthly net income (that is the pay that you actually receive in your account after your taxes and deductions). Make sure to include any other income you receive such as the Canada Child Benefit, any potential side-hustle income or other.

The next part will be to focus on your expenses. As you’ll see, I’ve separated the expenses in 5 different sections.

You are free to insert or modify the titles of the expense categories and decide to move them from one section to the next depending on your needs. Just make sure to verify that the formulas contained in any “total” cells are accurate following any changes. Feel free to reach out and grab a time for a 30 minute session if you have any issues or questions while preparing your own bare-bones budget.

Here’s a quick overview of what the different sections of expenses reflect:

Recurring Fixed:

- These occur on a monthly basis and tend to remain at a similar amount throughout the year.

- I’ve included Cellphones and Gas/Parking in this category, since I only negotiate my cell phone plan when the 2 year contract is up for renewal and since our basic gas/parking costs tend to remain pretty much the same throughout the year. Feel free to move these into another section if you find that they would fit best in a different one.

One Time Yearly Fixed:

- These are normally quite larger as they occur only once or twice per year.

- In that section you can insert the annual cost and the monthly average will be automatically calculated.

Recurring Essential Variable:

- These are the essential costs that can vary from one month to the next, yet will likely occur every month (or few months) as these are “essential” to your cost of living.

- Aim for a level of spending that you believe you could sustain if your were to reduce your spending to its bare-bones level, but try to be reasonable in the amount you set.

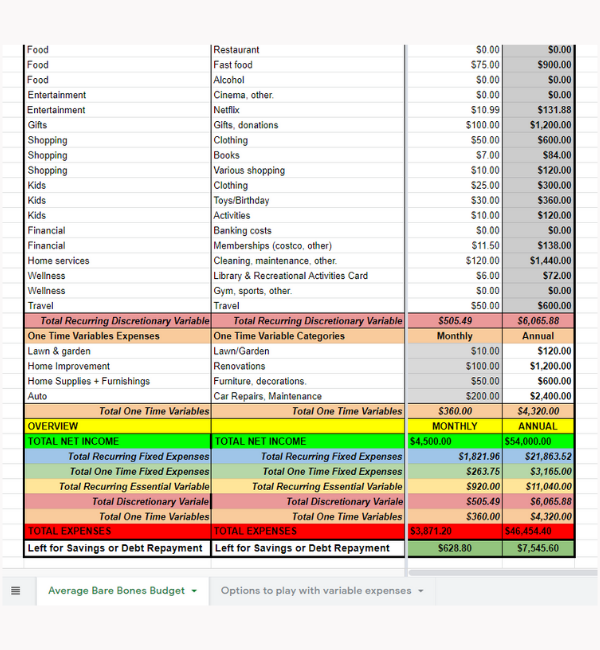

Recurring Discretionary Variable:

- Recurring Discretionary Variable:

- This is your “sexy” category as in, the fun things that add a bit of flavor to your life, yet you do not consider these to be necessary for your survival. This is where you should be able to reduce your expenses if you really needed to.

- Remember, we are trying to identify your Simple Bare-Bones Budget, one that you would only implement in necessary circumstances.

One Time Variable:

- These are similar to the one time yearly fixed though these can vary greatly from one year to the next.

- In that section you can insert the annual cost and the monthly average will be automatically calculated.

The final row in the template is very important. This will show the gap between your total income and your total expenses. It will therefore either highlight how much money you might have left over for debt repayments of savings, or what the gap might be if your income happens to be lower than your budgeted expenses.

Playing around with variable expenses

To help you play around with numbers for all of those variable expenses to create a realistic and simple bare-bones budget, have a look at the second sheet entitled “Options to play with Variable Expenses”.

In that sheet, you can modify the fields “Times Purchased / Month “ and “Unique Cost” and these will modify the value of your monthly and annual variable costs by calculating average expenses for those categories according to a specified purchase frequency. Remember to clearly define your unit cost in the field “definition of unit cost” for you to remember what you used when you return to the sheet.

Get your Simple Bare-Bones Budget Template:

To help you create your own bare-bones budget, I’ve designed a spreadsheet for you to input your own numbers. To access it, simply fill out the form below :

If you’d like to find out more about the importance of creating a Bare-Bones Budget and more information on how to do so, check out Cash for Tacos own Bare-Bones Budget Template and detailed post.

Related:

Do you use a bare-bones budget as a tool to know which spending you can cut when aiming for a higher savings rate, pay down debt faster or to deal with difficult financial times?

Have you had to implement a bare-bones budget as a consequence of the current difficult times?